Cheap Accountant Costing You £100,000?

How much unclaimed VAT could you be missing out on? Our recent client - £108,000.

Are you working with one of the cheapest accountants you could find? This might initially seem like the best way of cutting costs but we know first-hand how this can backfire in the long run.

Last year, we worked with a client who had hired a cheap accountant to cut bookkeeping costs. An understandable decision, however, they assumed that they were getting the same quality of service for a cheaper price tag. Here’s the issue – all accountants are not the same. Whilst we may offer the same services, there’s a huge difference between one who takes a surface level approach of making sure everything is correct on paper, and those of us who really work to understand our clients’ businesses and needs.

Working through our client’s accounts, our team discovered £108,000 of unclaimed VAT over a 1-year period. Their previous accountant had completely missed this and nearly led them to increase service prices due to missing profit margins.

It's easy to miss indications of your accounts being incorrect if you’re a business owner dealing with all other aspects of business management. You shouldn’t have to second-guess your finances after your accountant(s) have looked through them and sorted everything for you. Nevertheless, as the saying goes, you often times get what you pay for. In accounting, the difference between a cheap and a mid-range accountant can be massive. You may think you’re paying less but if it’s causing you to lose out on over £100,000 annually, is it worth it?

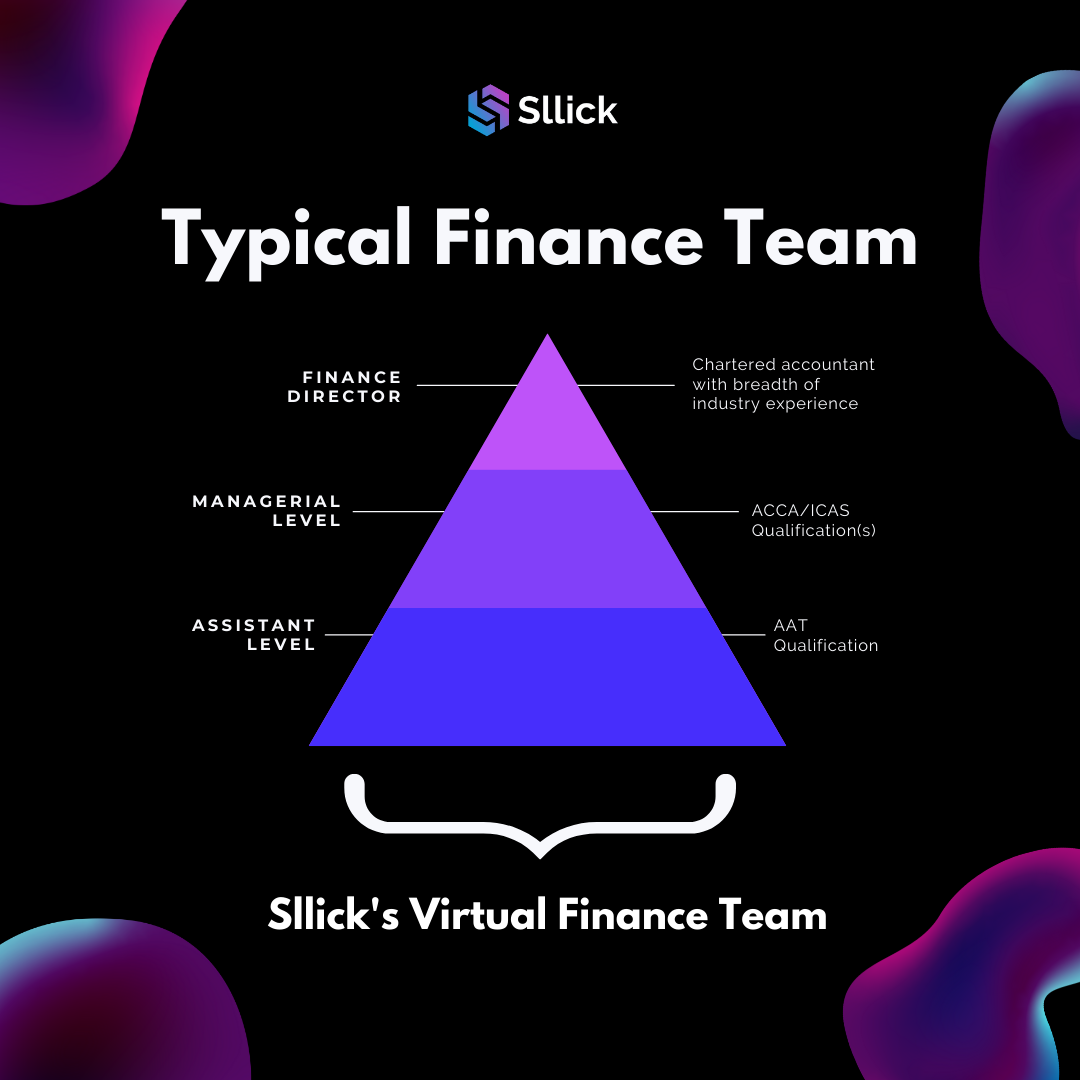

Your accountant should be an investment – someone whom you can trust to find the finer details, mistakes and opportunities in your finances. At Sllick, we always go above and beyond to understand exactly how our client’s business runs to offer what you want and need in an accountant. Our Virtual Finance Team gives you access to accountants of all levels and manages your day-to-day accounting needs for a fixed monthly fee. Your accounting information will always remain accessible to you and we’ll hold regular meetings to ensure you know exactly how your finances are performing!

We make sure to hold regular updates with our clients so that none of your financial information is a surprise and take an industry/business specific approach. We tailor our accounting processes to you, as opposed to applying a one-size-fits-all layout to our work.

To find out how you can make the most of your finances (and maybe claim some VAT you’ve been missing out on), book a free discovery call with our expert team today.